|

SOUTHEAST SNAPSHOT, APRIL 2005

New Orleans Multifamily Market

|

Larry Schedler

Larry G. Schedler and Associates, Inc.

|

|

Although the fundamentals of the metro New Orleans multifamily market are strong, the construction activity certainly has cooled down over the past few years. Unlike other major metropolitan areas, metro New Orleans retains a lack of suitable land for construction. Surrounded by water and situated 6 to 9 feet below sea level, with Lake Pontchartrain to the north, the Mississippi River to the south, and wetlands to the east and west, New Orleans developers have difficulty breaking into the market. However, the negative aspects that result from these geographic barriers, such as increased cost of construction and increased rental rates, have created an interesting trend not commonly found in most areas. The lack of new competition has allowed existing developers in the area to create franchises of sorts, as the stagnant market has made development extremely attractive to those that are already strong locally. In addition, one of the major trends in the New Orleans multifamily market has been a recent desire for living in the urban/warehouse district. As a result, roughly 25 percent of the multifamily projects are making a transition from rental units to condominiums. Therefore, expect to see a resurgence of condominium construction in 2005, but anticipate new construction of rental inventory as well.

Despite the fact that the market is difficult to penetrate, there is significant development in the area. The majority of activity is taking place in Slidell, located in eastern St. Tammany Parish to the northeast of New Orleans. Over the past few years, the submarket has added more than 1,000 apartments, compared to only 800 units built in the previous 10 years. The 144-unit Greenbriar Estates and Harborside Apartments, which boasts 168 units, are two examples of construction project in the Slidell area. Both developments are located on the north shore of Lake Pontchartrain. Although this submarket has seen quite a significant resurgence for multifamily projects in recent years, it is likely that these two communities will be the last constructed in Slidell over the next 18 to 24 months.

In Gretna, Calypso Bay Apartments has finished its first phase. When completed, the complex will feature 280 West Indies-style luxury apartments, and it is the first new apartment development in the submarket since the 1980s. The project will provide luxury housing for residents of the “westbank,” a privilege previously not available to them. Construction also continues on a project called River Gardens, which lies at the former site of the St. Thomas housing development, which had largely become uninhabitable, in the Uptown section of New Orleans. This development, located in the historic center of the city, will offer 296 units consisting of singles, doubles and four-plexes with an old New Orleans architectural theme. The convenience to universities, entertainment and employment centers and the historic appeal of Uptown New Orleans definitely should effect development of infill sites such as River Gardens.

The dilapidated communities are ripe for redevelopment, so this trend appears that it will continue in the New Orleans historic center, and this area certainly will see increasingly more action in the future. In addition to this area, the Northshore submarket (Slidell/Mandeville/Covington) offers convenience to employment, recreational activities and well-respected public schools. The area not only will see an increase in development for these reasons, but also since Northshore boasts one of the highest household income levels in the state, builders have a wealth of qualified tenants enticing them to continue construction.

These communities under construction are all being built by locally based developers. Shadowlake Properties is developing Calypso Bay in Gretna; New Orleans-based Sizelar Property Investors, a publicly traded REIT, is constructing Greenbriar Estates in Slidell; and Harborside Apartments in Slidell is being developed by private development firm Sabre Development. River Gardens is being constructed by HRI Properties, a New Orleans firm nationally reputed for redeveloping historically significant properties as a springboard for urban renewal.

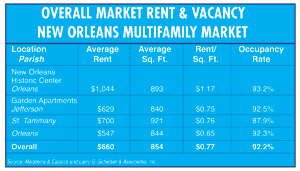

As far as market statistics go, a majority of the projects that have broken ground in metro New Orleans are targeting the upper end of the market. Luxury apartments are the growing trend, and in order to justify new construction developments, rental rates almost necessarily must be in the range of $0.95 to more than $1.00. A majority of inventory in the area is older than 25 years, and repositioning these developments has provided housing for moderate to low-income civilians. The average rent for apartments are as follows: studios average $434 per month; one-bedroom units are roughly $573 per month; two-bedroom apartments range from $646 to $808 for a month, depending on the number of bathrooms; and three-bedroom units average $1,001 per month. Overall, apartment units in the metro New Orleans market average 854 square feet and cost $660 per month ($0.77 per square foot).

New Orleans is still enjoying an overall occupancy rate of 92.2 percent. Individual occupancy rates for various areas are: 93.2 percent in New Orleans Historic Center; 92.5 percent in Garden Apartments (Jefferson Parish); 87.9 percent in St. Tammany Parish; and 92.3 percent in Orleans Parish. Despite metro New Orleans’ overall increase in vacancy, these numbers are significantly higher than rates in many other metro areas.

Barriers to entering construction in metro New Orleans have controlled the multifamily market, and the future appears promising for new development endeavors as well as for the existing inventory. Investors should continue to receive solid returns on their equity for years to come, and the strong fundamentals in the market should continue to thrive.

— Larry Schedler, CCIM, Larry G. Schedler and Associates, Inc.

SAVOY PLACE FOLLOWS NEW ORLEANS REVITALIZATION TREND

Related Capital Company, a subsidiary of CharterMac, recently has provided $15 million in equity financing for The Michael’s Development Company, which is planning to construct Savoy Place Apartments, a $40 million affordable housing complex in New Orleans. The HOPE VI program, which attempts to catalyze urban redevelopment by federally financing private investments to improve public housing, provided $20.7 million for the project, and the Housing Authority of New Orleans provided the remaining $5 million. Spurred by a condo conversion craze in the city, multifamily units are in high demand, especially in the affordable housing sector. Related Capital Company, a subsidiary of CharterMac, recently has provided $15 million in equity financing for The Michael’s Development Company, which is planning to construct Savoy Place Apartments, a $40 million affordable housing complex in New Orleans. The HOPE VI program, which attempts to catalyze urban redevelopment by federally financing private investments to improve public housing, provided $20.7 million for the project, and the Housing Authority of New Orleans provided the remaining $5 million. Spurred by a condo conversion craze in the city, multifamily units are in high demand, especially in the affordable housing sector.

The complex is located 6 miles from downtown New Orleans near the intersection of Alvar Street and Higgins Boulevard, and the new 318-unit Savoy Place Apartments will mark the second phase in the development of a multi-phase complex, which encompasses 100 acres, featuring 100 for-sale homes, 425 rental units, a community center and a school. The units at Savoy will range from one to five bedrooms, utilizing 714 to more than 1,800 square feet, and rents for non-subsidized units will range from $172 to $675 per month. Completion of the project is expected for summer 2006.

— Dan Marcec |

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|