|

CITY HIGHLIGHT, AUGUST 2009

BALTIMORE CITY HIGHLIGHTS

Todd Evans, Tom Maddux, Abby Glassberg

Baltimore Industrial Market

Buoyed by its proximity to Washington, D.C., and the resulting presence of multiple government installations — as well being the East Coast’s farthest inland sea port — Baltimore enjoys a marginal insulation from the global economic slowdown. The Social Security Administration, the Health Care Financing Administration, the National Security Agency, Ft. Meade and Aberdeen Proving Ground are all federal government outfits in the area that employ Marylanders at well above average salaries. These agencies require significant private contractor support which, in turn, supplies even more well paying jobs.

Baltimore, however, is not immune to the credit crunch. At approximately 190 million square feet of space, Baltimore’s industrial market has seen some recovery at the end of the second quarter. Leasing is up half a percent from last quarter, settling at an overall vacancy rate of 10 percent. With asking rates hovering just shy of the $5 triple-net mark, developers have sharpened their pencils a bit after sitting on recently-delivered product in a market that was flooded with new construction for most of 2008. Asking rates were previously based on construction costs and projections that were developed during the boom times of 2006 and 2007. The tenant has become king, with multiple opportunities to upgrade his space at competitive rates with aggressive terms.

Notable transactions this quarter include Price Modern, which leased 92,000 square feet in a 40-year-old building in Baltimore that ProLogis had recently acquired and redeveloped. Head USA renewed just more than 100,000 square feet at Swan Creek Drive in a modern 28-foot clear height warehouse at the northern tip of the Baltimore-Washington Corridor. Additionally, Graham Packaging has stepped up for 160,000 square feet at the former Fila facility adjacent to the Port of Baltimore.

Well-financed users seeking to purchase buildings remain on the sidelines, patiently waiting for the market to hit what they perceive to be the bottom. Developers have not enjoyed the same anticipation and are beginning to cut their losses.

It is not all doom and gloom for developers. First Industrial Realty Trust recently sold a manufacturing facility to an existing tenant, System Source, for just less than $100 per square foot, or roughly $7 million, in the Hunt Valley area.

There is plenty of new and second-generation space to fill. First Industrial has 300,000 square feet in a 2-year-old, never-occupied building in eastern Baltimore County. Within close proximity, RREEF has more than 300,000 square feet of second-generation space available in two projects. Multiple projects both north and south of Baltimore’s tunnels sit only partially developed because of a lack of both tenants and available financing for shell construction and tenant improvement work.

H&H Rock has undertaken a 600,000-square-foot warehouse development on the east side of Baltimore with tremendous visibility from Interstate 95. One 82,000-square-foot building has already delivered and is 50 percent leased.

The west side of town has become Baltimore West Express with FedEx, Service Express and Bakery Express all taking delivery of space within earshot of each other during the past year. FedEx and Service Express are the only companies operating at the 50-acre, potential 700,000-square-foot redevelopment of a former Super Fresh distribution center. At least 250,000 square feet is yet to be built, and another 280,000 square feet sits vacant.

Duke Realty has delivered two buildings at Chesapeake Commerce Center — totaling 342,500 and 117,600 square feet — both of which filled relatively quickly. Notwithstanding Duke’s development plans for an additional 2 million-plus square feet, the Midwest-based giant has no immediate plans to speculatively build on that site. Duke has recently sold land at the site to both a user and the Port.

— Todd Evans is an associate with NAI KLNB in Towson, Maryland.

Baltimore Retail Market

Change was an oft-repeated concept in the political arena last year, and the theme continues to reverberate throughout the Baltimore retail market as we approach the mid-point of 2009.

In this area of the Mid-Atlantic, the past 15 years were defined by aggressive and well-conceived development activity, spurred by the rapidly expanding residential growth that sprawled to all corners of the region. Leasing kept pace with this building frenzy, buoyed by consumer demographic statistics that were the envy of nearly every other area of the country.

As residential growth also occurred in urban areas — specifically the rise of new condominiums and renovated row houses in downtown Baltimore — retail development followed like a loyal dog. Big box and grocery stores entered the market for the first time to take advantage of people moving from the suburbs as well as downtown workers shopping during or after work.

De-malling was all the rage as developers transformed dead or mostly vacant shopping mall assets into Main Street-like and entertainment-style retail destinations. Hunt Valley Towne Centre is recognized as the poster child for these efforts, but success stories also occurred at the former Parole Plaza, Glen Burnie Mall, Westview Mall and Golden Ring Mall.

Fast-forward to early 2009. Projects are still coming out of the ground, and leasing is holding steady (at least for centers that are being delivered this year), but the national credit crisis has placed a hold on anything not already underway. The sudden halt of new residential starts has eliminated the carrot, which the stick always has followed.

Traditional sources of capital have all but dried up. Most banks have lost their appetite to fund speculative retail centers. Developers that have initiated new projects and have received preliminary construction financing are facing additional stress in securing permanent lending opportunities. This uncertainty has frozen a number of potential new centers that may have broken ground in less unsettled times.

In the Mid-Atlantic, we are experiencing a consumer buying environment that has created an “economy of needs” versus an “economy of wants” situation. With diminished spending power, families are asking themselves if they really need that car or television or if they simply want those items. Grocery store shopping falls into the essential category, while furniture and electronic products are filed into the “I can buy it at another time” category.

Our market has been through this situation before — the bankruptcy of the venerable Hechinger’s home improvement store immediately comes to mind — but there are a rapidly increasing number of big-box stores available for rent or sale. Former Boscov’s, Circuit City, Linens ‘n Things and Tweeter locations have flooded the market, all at approximately the same time. With more supply than demand, the stores that absorb this space will likely pay less rent than their predecessors.

— Tom Maddux is president of KLNB Retail.

Baltimore Office Market

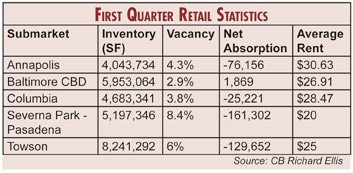

For the first time in 5 years, the Baltimore metropolitan office market realized a negative net absorption in the first quarter of 2009. During the first quarter, the market’s overall vacancy rate also pushed past the 15 percent mark. Although a few tenants decided to look for greener (and less expensive) pastures in neighboring suburban markets, counties such as Anne Arundel, Baltimore and Howard were not immune to the deteriorating environment themselves. Cumulative vacancy rates in those areas climbed approximately two percentage points to just less than 15 percent.

While tenants that announce they are vacating buildings remain a continuing headache for landlords and owners, companies with intentions to stay are causing issues and concerns as well. Brokers and owners call this the “blend and extend” phenomenon. Consider the fictitious Baltimore Financial Conglomerate (BFC), which has 3 years left on a 5-year lease in which they are paying $27 per square foot. Business is good for BFC — although things could be better — and the company is very aware of the dynamics in the local real estate market. Namely, the asking rental rate for BFC’s building has dropped nearly $2 since the firm originally inked the lease 2 years ago.

BFC has no plans to leave its building and would, in fact, be interested in extending the lease for several more years, just not at the original $27 per square foot. That price represented a high-water mark for the rental rate. BFC officials want to sign a new lease at the present-day level of $25 per square foot. With landlords getting pinched from all sides and anxious to retain tenants at almost all costs, most are negotiating in good faith to preserve the relationship. Some paranoid owners are resistant to publish current rental figures for fear of additional “blend and extend” situations. Mirroring other major cities across the country, office leasing remains a tenant’s market.

Baltimore’s close proximity to Washington, D.C., combined with the continued economic strength of the corridor marketplace, has helped the Baltimore office market string together a series of good years. The weakening financial services sector has primarily caused the unemployment rate to slowly rise past 7 percent. This ascension has caused a feeling of uncertainty to permeate the commercial real estate market. Uncertainty about jobs has slowed leasing activity. The 600,000-square-foot Legg Mason tower, which overlooks the water in Harbor East, is doing well and is scheduled for a fall delivery. But unfortunately, leasing activity is tepid in other downtown Baltimore office projects.

In the Baltimore metro area, the average asking rental rate has dropped slightly to $22.90 per square foot, although owners of Class A product are starting to lower their rates to stay competitive. This, in turn, is placing increased pressure on Class B product. Certain REITs are becoming increasingly creative in their proposals. These firms have begun offering initial rental rates that start lower and accelerate in price more slowly. Companies that are perceived to have the financial wherewithal to fund a tenant’s build-out remain at a competitive advantage.

Things might get worse before they get better. New construction continues in the downtown market, and nearly 1 million square feet of space is expected to enter the inventory during the course of the next year. Owners can fight back by keeping a sharp eye on operating expenses and saving pennies wherever possible. Here’s another thought: Remind your tenants that you don’t ask for rent increases when business is good, so they shouldn’t be tempted to do the reverse.

— Abby Glassberg is first vice president, investment properties, for the private capital group of CB Richard Ellis in Baltimore.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|