|

COVER STORY, DECEMBER 2009

2010 SOUTHEAST OFFICE OUTLOOK

Charlotte

Activity in Charlotte at the end of 2009 and heading into next year will be concentrated in a few submarkets. Office transactions in the Ballantyne and Northwest University areas have picked up. Velocity isn’t what it once was, but the fact that interested parties are pursuing properties bodes well for 2010.

“Deals are still being done,” says Frank McCleneghan of Piedmont Properties|CORFAC International in Charlotte. “They’re still a little bit far and fewer between than they were 2 years ago, but we still see some activity.”

This can be attributed to a substantial amount of pent-up demand on both the sales and leasing side. Last year, 12-month renewals were the largest deals landlords were offering tenants, simply because owners were unsure of the future. In the past 4 months, McCleneghan says, he’s brokered four leases, each totaling between 3 and 5 years. This doesn’t mean good times are here again; McCleneghan says it’s still a long journey back to a healthy market. “My gut feeling is that it’s going to stay fairly flat here for another 3 to 6 months and then things will start to pick up,” he says.

Landlords in the central business district are still anxiously awaiting any fallout from the merger of Bank of America and Merrill Lynch and Wachovia and Wells Fargo. The banks are large users of space. Shuffling of operations could create additional vacancy in the market. Bank of America will open 1 Bank of America Center, a 750,000-square-foot tower during the third quarter of next year. The building has been designed to achieve LEED Gold certification. More than 250,000 square feet of space in the development is currently on the market, McCleneghan says. “Everybody thinks they’ll still have a strong presence in Charlotte,” he says.

The uncertainty in the market currently has pushed major concerns about financial users to the background, but Bank of America could become a major antagonist to the office sector next year. Even if more vacancy opens up, McCleneghan predicts the market will only get better next year.

“Charlotte is a very resilient town. There aren’t a lot of vacancies in Charlotte,” he says. “Right now, it’s better than it was 12 months ago, and I expect it to be a little bit better than it is right now 12 months from now.”

Miami

When a market is plagued by negative absorption, rent decreases and a large vacancy rate, it’s hard to see a sliver lining. Add 2.4 million square feet of office space that’s under construction in the central business district to the picture, and any outlook for the next year in the Miami office market is shaded gray.

One positive factor is that the market isn’t in flux, and for the past few months, the real estate hemorrhaging has stopped. “We’ve come to a degree of stabilization in the sense that we have seen larger transactions transpire over the past 2 to 3 months,” says Brett Harris, president of Miami-based Adler Group. “We’ve also seen that in the suburban marketplaces, where we think the tenants have finally realized that they have to come to grips with the current flux of the economy.”

For an office sector to thrive, firms need to hire workers and conduct business as usual. In the current landscape, this simply isn’t possible. “You can see that on the earnings reports, where the profits haven’t come from growth revenue; the profits have primarily come from the reduction of operating expenses,” Harris says.

New development is at a standstill, which, considering all the space that will deliver in the near future, is a positive point for landlords. One large chunk of that space is 1450 Brickell, a 586,000-square-foot, Class A office space. The LEED Gold property, which is being developed by Miami-based RILEA Group, is set to deliver in the first quarter.

In an effort to help companies generate cash, Adler Group has partnered with Holly Sime Realty to provide property management services for landlords trying desperately to stay afloat. “You’ve got to generate more revenue from alternatives,” he says, “to add more to the rental income stream.”

For the market to turn around, however, the unemployment rate needs to drop, and the government’s stimulus package needs to keep flowing into the city. When that happens, Miami can start filling vacant office space and look to a new day.

Birmingham

Entering the end of 2009, the Birmingham office market looks pretty much the same as it did this summer: stagnant. A handful of companies are looking around at moves they could make in the future, but for the most part, firms are staying put and not spending any money. In this market, mergers and acquisitions are the fire that fuels transactions.

“I don’t see too many groups getting out and moving just because,” says John Hennessy of Birmingham-based Sandner Commercial Real Estate.

The market is churning along at a snail’s pace, but a promise of future activity has been wafting through the air. The recent announcement that Tampa, Florida-based Walter Energy will relocate its headquarters to Birmingham is big news in the current market, and Hennessy hopes more announcements like that are in the not-too-distant future. “I have felt in the past few months that some people are more willing to open up about their businesses and their real estate issues,” he says. “I don’t know if that is because of a time-sensitive component with leases expiring or maybe people are just hopeful about the number 2010.”

This turnaround won’t be connected with development — there are no current projects being constructed, and the pipeline has dried up. Hennessy says some developers are trying to generate interest in new projects, but these are few and far between because finding funding is next to impossible. Pre-leasing requirements are a high barrier to overcome, and banks, for the most part, will not lend money due to the uncertainty in the market.

Many more challenges will present themselves before the Birmingham office sector is again running stable. Looking to the end of next year, Hennessy is worried about loan maturities and the financial panic that will ensue when owners can’t obtain new loans. For now, however, brokers, owners and tenants are focused on the first few quarters of 2010 and the good news that may come with the new year.

“People are ready for 2009 to be behind them,” he says. “It’s got to get better, but I still don’t see it getting better until the third or fourth quarter of 2010.”

Washington, D.C.

|

1999 K. St. in Washington, D.C.

|

|

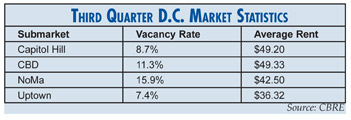

The largest transaction in the Washington office market happened this fall. On August 31, Vornado Realty Trust sold the 250,000-square-foot 1999 K. St to Deka Immobilien GmbH, a German investment fund, for more than $200 million. The LEED-CS certified building, which had just been completed at the time of the sale, currently houses the law firm Mayer Brown. This transaction represented a small glimpse of sunshine in a market that’s been paralyzed by a lack of financing, says John Mullen of Marcus & Millichap’s National Office and Industrial Properties Group. “Large deals aren’t moving for the most part,” he says. “The cash flow isn’t there. The lenders aren’t lending on those assets.”

Leases in the current market are also suffering. The 2.6 million square feet of office space delivered in the second quarter is forcing rents downward and has created an overabundance of sublease space. The vacancy rate stands at more than 10 percent. Mullen expects the transaction picture to improve next year.

“On the sales side, we’re going to see an influx of product that’s going to hit the market,” he says. “There’s going to be a bunch of cash to hit the market, and there are going to be a lot of sellers that have to do something. They’re going to realize, ‘look, this market’s not going to flip like we thought it would.’”

The small growth occurring during the next year will lead to more sales in the $10 million-and-under range. Sellers have begun to heed the advice of brokers who have been telling them the market is primed for transactions. “If you’re going to have to do something within 5 to 10 years, do it now,” he says. “We’ve been saying that; they’re just starting to listen.”

Brokers would like activity to pick up, as more than 6.3 million square feet of office space is currently under construction in the area. These developments are scheduled to deliver through the end of 2011; Mullen says about 3.2 percent of the projects will be finished by the end of the year. The highest ratio of this space will deliver in the NoMa area.

While it may be impossible to regain pre-recession levels of activity, Mullen knows a real estate turnaround is in Washington’s future.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|