|

COVER STORY, DECEMBER 2009

2010 SOUTHEAST INDUSTRIAL OUTLOOK

Charleston

Fear was a primary additive in the poisonous cocktail of the recession. In the Charleston industrial market, tenants and landlords have long since emerged from their shells and have started pursuing deals and helping generate activity.

“It’s not nearly as panic-driven as the fourth quarter of 2008 and the first quarter [of 2009]. It seemed like people were literally paralyzed with fear,” says Mike Ferrer of Mount Pleasant, South Carolina-based Grubb & Ellis|WRS. “Now, especially on the leasing side, tenants are starting to realize that they can get themselves deals and are trying to secure longer term deals at competitive rates.” These deals simply didn’t exist 18 months ago, he adds.

That the fear is gone certainly helps the situation, but Charleston industrial brokers are still dealing with a slumping market. Sellers and buyers are in short supply, and as developments are delivered, sublease space has increased. “This makes it more difficult for landlords to compete because sublessors are trying to offset loss, not make a profit,” Ferrer says.

The next big hurdles in the industrial market are the loans coming due next year, which will be a big challenge for the area. In a time when banks simply won’t offer refinancing, a large number of loan maturations may be tough to overcome.

“Obviously, a lot of people in Charleston are going to be affected by that because not everyone’s going to be able to get refinancing,” Ferrer says. “A lot of guys are going to find out that their property is worth a lot less money, and they’re going to have to come up with a lot more money to keep that loan in place or to get a new loan. Not everybody’s going to be able to stomach that financially.”

The positive news coming from Charleston is that there are significant developments under construction. The Boeing Streamline Plant, which is predicted to generate 300 jobs, is currently under construction. Ferrer has heard that up to 40 suppliers could move into the area to support Boeing’s operations at the plant. Another huge development is TBC Corporation’s 1.1 million-square-foot distribution center, which broke ground during the fourth quarter. A joint venture between Rockefeller Group Development Corporation and MeadWestvaco Corporation is building the development in the 400-acre Rockefeller Group Foreign Trade Zone/Charleston. “That’s going to be a tremendous boom for the economy,” Ferrer says.

Atlanta

Industrial tenants making deals in Atlanta are looking to the first quarter of next year. While the first half of 2009 was sluggish due to the recession and few leases were completed in the summer, J. Austin McDonald of Atlanta-based McDonald Development Co. saw activity pick up in late October and November.

“We’re optimistic that people are looking at 2010 as a time to make some decisions and maybe look for new space,” McDonald says. “Not a lot of tenants have been willing to move; they don’t want to incur the cost, but they also don’t want to make a long-term commitment and sign a 5-year lease in a new space when they don’t really know what things are going to look like in the future.”

As the recessionary picture has become more clear, McDonald believes companies have been instilled with the confidence to move forward. By the end of this year, he says, firms will have downsized and set most of their books straight. This will prime them for a turnaround early next year. A large amount of activity will come from firms moving to the area from overseas.

“When you look at the statistics, a lot of the European companies came out of the recession over the summer and are therefore ahead of us by about 6 months. With the low cost of the dollar, they are probably in a better position to start making moves in the next several months,” McDonald says.

These tenants won’t see much new development in the city, however. It’s extremely difficult for developers to find financing in the current market, and, in some cases, it’s a challenge to even complete build-to-suit projects that were started as the recession hit. Going into next year, build-to-suit opportunities will increase as financing becomes more available.

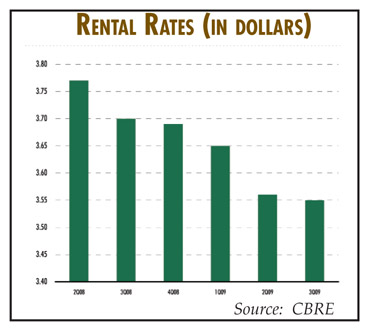

“There will be some build-to-suits, and we’ll see leasing activity pick up and rental rates stabilize and maybe increase slightly,” McDonald says. “We’ll see not much new construction.”

The next year will also usher in new challenges in the Atlanta industrial market. When rental rates increase to pre-recessionary levels, inflation may become an issue. In general, however, McDonald predicts that industrial will enter the new year poised for revitalization and will soon be outperforming other area property types.

“It’s going to be a slow growth,” he says. “We’ll have several positive years.”

Clarksville, Tennessee

In the depths of the economic downturn, the Clarksville industrial market is firing on all cylinders. Industrial brokers and developers are active, and there is a palpable excitement about the future. Most of this activity emanates from the ongoing construction of Hemlock Semiconductor’s $1.2 billion facility, which broke ground in November and is expected to be complete in 2012. The facility is being built on a 2,100-acre site in Clarksville’s Commerce Park. The nascent construction has already provided a big boost for the city. In the coming months, the project will help attract additional industry to the area.

“There will be, I’ve been told, in excess of 300 vendors that will have to have some level of presence here to supply that facility,” says Wayne Wilkinson of NAI Clarksville.

Developers — who, until now, have dealt mostly with smaller projects if at all — will have to start pursuing build-to-suit contracts and planning speculative buildings because there simply isn’t enough existing warehouse space in the city to accommodate all the suppliers.

In the next year and into 2011, Clarksville will come alive with construction activity. The industrial market has waged a winning battle against the recession, but activity had tapered off a bit from previous years. “We’ve been a little bit insulated,” Wilkinson says. “We’ve had no plant closures, and we’ve had some plant expansions.”

While creating additional space and finding the right property for each company could be an onerous task, it’s a nice problem to have in the current market. The relocation of Hemlock Semiconductor and related projects will ensure that the Clarksville industrial market has a busy 2010.

“We don’t have enough existing product to come close to providing facilities for these vendors that are coming in,” Wilkinson says. “It’s a pretty good situation here. The only challenges that we have are supplying the product for these companies to house their facilities.”

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|