|

SOUTHEAST SNAPSHOT, FEBRUARY 2005

Birmingham Industrial Market

|

|

Sonny Culp

Graham & Company Inc.

|

|

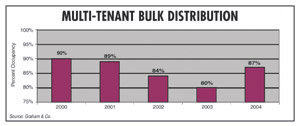

2004 was the “comeback year” for Birmingham, Alabama’s

industrial market, as occupancies rose after the multi-tenant

bulk distribution market experienced consecutive occupancy

declines in 2002 and 2003 at 84 percent and 80 percent, respectively.

The same October 2004 snapshot yielded an 87 percent figure

and a record absorption of 1.04 million square feet. Multi-tenant

absorption in a good year is historically around 300,000 square

feet. The increase is attributed to a general market rebound

combined with well-timed absorption of new speculative deliveries.

The mature Central and Oxmoor submarkets predictably began

to backfill post-September 11 vacancies consisting of subleases,

second generation space, and Class B/C industrial space. Rental

rates and occupancy levels should continue to trend upward

in 2005. The combined Central and Oxmoor bulk multi-tenant

markets (5.72 million square feet) are currently 86 percent

occupied. Limited land supply is the main barrier to new construction

in these submarkets, so rehab projects are more the norm for

developer opportunity. One 2004 Central market redevelopment

of a 40-year-old industrial facility newly leased for 15 years

to GCR Tire Centers sold for a sub-8 cap rate. In the Oxmoor

area, recent leases were signed with Lazy Boy (33,000 square

feet), PODS (33,000 square feet) and Armstrong Relocation

(60,000 square feet), among others.

New industrial development is primarily occurring in the outlying

Eastern and Southern submarkets where site availability and

access are more conducive. The most active development in

2004 was the Jefferson Metropolitan Industrial Park, located

on the west side toward Mercedes-Benz. The 300,300-square-foot

first phase of Graham & Company’s development was

delivered in June at 40 percent pre-leased and is now fully

leased to Mercedes supplier Decoma (120,000 square feet) and

D&K Healthcare (180,000 square feet). The 240,000-square-foot

second phase was delivered in December and is also fully leased

to OfficeMax (180,000 square feet) and Plastipak (60,000 square

feet) for support space to substantial facilities located

in the same park. Perhaps the most notable news in this submarket

is that in late 2005 Mercedes will vacate 525,000 square feet

at Perimeter Industrial Park and move to a similar sized build-to-suit

across from the plant itself in Vance, Alabama. The vacancy

effect will not impact the market until January 2006. Graham

& Company is serving as developer of the new Mercedes

facility. Not all was rosy on the spec development side. An

Interstate 20 corridor project, Moody Commerce Park, continues

with 130,000 of 182,000 square feet vacant after a late 2003

delivery. Disappointingly, there has not been metro area industrial

activity associated with the recent Honda plant expansion

in Talladega County. The combined South and East bulk multi-tenant

markets (3.42 million square feet) are currently 91 percent

occupied.

Except for the mentioned Mercedes project, no build-to-suit

activity is projected in the first quarter of 2005. Industrial

user activity continues to be spurred by low interest rates

and will continue to give the industrial market velocity in

terms of brokerage activity and general expansion. The most

notable user news is that Del Monte will dispose of a high-quality,

rail-served distribution facility of 293,000 square feet when

the food giant relocates to Atlanta this March. The outlook

for 2005 is for a continued rebound in existing vacancies

with absorption levels falling back into historical trends.

A 2005 speculative building may be initiated by Graham &

Company on existing building pads as dictated by market conditions.

— Sonny Culp, Graham & Company Inc.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|