|

COVER STORY, JANUARY 2012

SOUTHEAST SURVEY: BULLS OUTNUMBER BEARS

Industry pros anticipate more deal volume in 2012.

Savannah Duncan

The exclusive online survey conducted by Southeast Real Estate Business concluded that as a whole, there is a sense of cautious optimism that business will pick up in 2012 compared to 2011, although recovery will continue to be slow.

In the broker survey, respondents were asked if commercial real estate values in the Southeast have hit bottom. More than half of the respondents (52.3 percent) indicate recovery in the Southeast is spotty, varying by property type and location. Moreover, 30.5 percent say values have hit bottom, and 15.6 percent believe it has not yet seen its lowest point. See Broker Opinions of Value.

“The commercial real estate market in the Southeast has started to recover on a broad basis,” says Al Isaac, president of Lexington, Kentucky-based NAI Isaac Commercial Properties. “However, there will still be geographic areas with vacancy issues.”

Developer/Owner/Manager Results

Of the respondents to the developer/owner/manager survey, 44.9 percent intend to be a net buyer of commercial real estate properties in 2012, compared to 22.4 percent who plan to be a net seller. Additionally, 17.9 percent do not plan to sell or buy, and 14.7 percent were uncertain. See Buy, Sell Or Hold.

“It is a great time to invest in commercial real estate for a number of reasons,” says Jeff Garrison, partner of Fairburn, Georgia-based SJ Collins Enterprises. “Interest rates are low, debt is available, quality commercial real estate is less volatile than stocks, tenant demand is accelerating, and market supply is limited.”

Those who intend to be net buyers cited retail grocery/drug-anchored centers as their most desire asset at 42.1 percent. Other sectors including multifamily (32.9 percent), retail single tenant (27.6 percent), mixed-use (22.4 percent), and retail lifestyle/power centers (21.1 percent), are also of interest to buyers.

Conversely, the two most common assets net sellers intend to dispose of are retail single tenant (30.4 percent) and multifamily (26.1 percent). Additionally, suburban office and retail grocery/drug-anchored centers tied at 21.7 percent, and industrial and student housing were both 13 percent.

“Retail grocery/drug anchored centers remain the preferred asset class for investment because of the strong credit associated with a grocery/drug anchor and the resilience of these centers in a down economy,” adds Garrison.

More than half (59.3 percent) of developers have projects in the Southeast in their development pipelines that will break ground next year. More than three in 10 respondents (33.3 percent) indicated they will build retail single-tenant, followed by multifamily (27.8 percent), mixed-use (20 percent), retail lifestyle/power centers (17.8 percent) and retail grocery/drug-anchored center (15.6 percent). See Shovel-Ready Projects.

“Development is currently niche orientated and relationship driven,” says Scott Delaney, vice president of Mobile, Alabama-based Delaney Development. “There just isn’t a broad spectrum of opportunities out there right now, but that doesn’t mean deals aren’t getting done.”

Although multifamily was the darling of commercial real estate during the past year, Jeff Furman, vice president of development and director of the Raleigh, North Carolina, office of Northwood Ravin, adds, “Multifamily development will be a race to see which projects can get going before the banks get nervous about oversupply.”

Another interesting result of the survey was that 30.7 percent believe their negotiating leverage with retail tenants will be stronger in 2012. More than four in 10 respondents (47.1 percent) believe their negotiating leverage will be the same, 12.1 percent thought it would be weaker and 10 percent were uncertain.

“We continue to see strong demand from national tenants for well-positioned retail projects throughout the Southeast and expect to see a continuation and acceleration of this trend in 2012,” says Garrison.

For office and industrial leasing, respondents were hesitant, with the highest responses stating it would either be the same as 2011 or uncertain. For office tenants, 38.7 percent of respondents believe negotiating leverage with will be the same in 2012, while 24.4 percent were uncertain. In negotiating leverage with industrial tenants, 42.1 percent of respondents were uncertain whether it would be stronger, weaker or the same, and more than three in 10 respondents (31.8 percent) anticipated their leverage would be the same.

Lender/Mortgage Broker Results

Of the lender respondents, three-fourths (76.6 percent) expect the total dollar amount of commercial and multifamily loans closed by their firm to increase in 2012, while 17 percent thought it would remain the same and 6.4 percent thought it would decrease. More than one-third of respondents (38.2 percent) anticipate lending activity totals will increase by more than 20 percent. See Projected Growth In Loan Volume.

“The economy is improving even if only gradually, some areas of the country are improving more rapidly than others, there are even more maturities occurring in 2012 than 2011 and that number continues to increase over the next 5 years,” says Tim O’Connor, executive vice president of NorthMarq Capital’s Orlando, Florida, office. “The spreads available in commercial real estate will continue to prove attractive to institutional lenders in comparison to other investment vehicles, and the modest comeback that CMBS made in 2011 will continue to improve in 2012.”

There are many factors impacting the debt financing market for commercial real estate. A little more than half (54.2 percent) of respondents indicated that the health of the U.S. economy would have a high impact on the debt financing market in 2012. In addition, 48.9 percent believed valuations for commercial real estate would have a high impact as well.

“The availability of capital for the financing of commercial real estate in 2012 will largely depend on factors beyond the control of the industry,” says Bob Stout, president and CEO of Q10 Capital, based in the Nashville office. “[Factors] include the European debt crisis, the U.S. deficit, the ballooning U.S. debt and the regulations that ultimately come out of the Dodd Frank legislation. The uncertainty surrounding all of these issues has caused substantial amounts of capital to go to the sidelines and remain there.”

Additionally, 61.7 percent of respondents believe the fate of Fannie Mae and Freddie Mac will have a high to extreme impact on the debt financing market during the next 12 months. A little more than half (53.2 percent) of the respondents indicated the state of the CMBS market will have a high to extreme impact.

“The success of the CMBS market is critical to the success of commercial real estate,” says Barry Hines, member of Frost Brown Todd Attorneys’ Louisville, Kentucky, office. “More than $400 billion in CRE must be refinanced in 2012. CRE allocations among all U.S. life insurance companies will be in the range of $50 billion, leaving a $350 billion hole. Commercial banks don’t have the balance sheet to bridge the gap.”

More than one-fourth (27.9 percent) of respondents project total domestic CMBS issuance in 2012 will fall between $30 billion and $39 billion. Additionally, 25.6 percent believe CMBS issuance will be less than $30 billion, and 20.9 percent project it will land between $40 billion and $49 billion. Only 2.3 percent of respondents anticipate CBMS issuance in 2012 could be more than $100 million. See Securitized Lending Outlook.

In the Southeast, lenders indicated they are most bullish on multifamily properties. Eight in 10 respondents (81.6 percent) cite multifamily as the property category with the most attractive investment opportunities in the Southeast. Nearly six in 10 (57.1 percent) believe retail grocery/drug-anchored centers are good investments and 55.1 percent indicate medical office is desirable as well. See Favorties of Finance Community.

“We continue to be bullish on multifamily,” says Rick Murphree, manager of the CRE portfolio and strategy of Knoxville-based First Tennessee Bank. “Capital for multifamily housing is plentiful, accessible, and relatively cheap. This reduces the exit risk (both sale and refinance); which is important as most of our multifamily lending is for the construction of new projects. The outlook for office, retail, and industrial is improving but very slowly. The single-family residential market continues to be comatose.”

Brokerage Results

More than two-thirds of broker respondents (64.6 percent) expect their firm’s total transaction volume by dollar amount (leasing and investment sales combined) in the Southeast to be higher in 2012. Additionally, 27.8 percent believe transaction volume will be the same and 7.6 percent believe it will be lower. See Broker Outlook for Deal Volume.

Three in 10 respondents (32 percent) who believe transaction volume will increase, thought it would do so by 5 percent to 10 percent, while one-fourth (25.2 percent) believe it rise by 11 percent to 15 percent. See Projected Growth in Brokerage Activity.

“The gap between seller and buyers expectations is narrowing,” says Charley Hankla, managing director and principal of industrial sales and leasing at Cassidy Turley’s Nashville, Tennessee, office. “Sellers are seeing that holding out is not in their best interest, as the costs to ‘hold’ continue to mount. Buyers have become somewhat more realistic in their approach, and if financing is available, they can make excellent deals on owner-occupied buildings.”

N. J. (Joey) Godbold, president of Charlotte, North Carolina-based Percival McGuire Commercial Real Estate, adds, “As in 2011, we expect to experience in 2012, a bifurcated market. On one hand, we will continue to see an excessive amount of idle cash chasing high-quality investment properties while, on the other hand, stressed and distressed properties will be met with a vulture mentality.”

Two-thirds of respondents (64.3 percent) believe the multifamily sector will experience high velocity in sales in 2012. Other popular property categories include retail single-tenant (34.9 percent), medical office (33.3 percent) and retail grocery/drug-anchored centers (27.1 percent).

Conversely, 43.5 percent of respondents believe retail mall properties will experience a low velocity of sales in the Southeast next year. Downtown office was a close second with 41.1 percent, followed by suburban office at 39.5 percent. See What’s Hot, What’s Not On Sales Front.

“Income producing property in good condition with a strong future is still highly desirable and in extremely short supply,” says George Kurz, broker at Baton Rouge, Louisiana-based Kurz & Hebert. “With more liquid returns almost non-existent and the cost of money at unprecedented lows, real estate is still one of the best options out there when looking at return.”

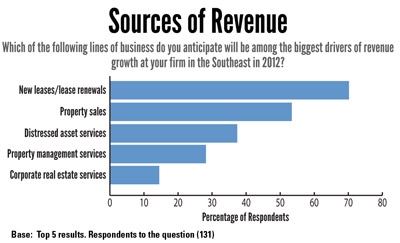

When asked which lines of business will be among the biggest drivers of revenue growth at their firm in the Southeast in 2012, 70.2 percent of respondents cited new leases and lease renewals. More than five in 10 (53.4 percent) indicated property sales and 37.4 percent pointed to distressed asset services. See Sources of Revenue.

For office leasing, tenant improvements/build-out allowance (69 percent) and base rent (61 percent) are the two biggest sticking points between owners and tenants. Of the respondents, 69.2 percent indicate the health care industry will drive office leasing growth in 2012. Additional potential growth sectors include technology (35.9 percent), biotech (32.5 percent) and financial services (25.6 percent).

The retail results were similar to office in that nearly six in 10 (59.3 percent) say tenant improvements/build-out allowances are the biggest sticking point between owners and tenants for retail lease negotiations, and half of respondents (50.4 percent) say base rent is an issue. Interestingly, 17.7 percent selected other and several commented that co-tenancy clauses have been a sticking point.

For industrial leases, base rent is the biggest negotiating point, say 64.9 percent of respondents, and length of the lease follows with 47.4 percent.

“Tenants are demonstrating resistance in some cases to moving forward because of uncertainty in the economy and their need to focus on their own revenues even if their lease renewals are expiring soon,” says Michelle Rich Goode, founder of Raleigh-based Rich Commercial Realty. “[It is a] very frustrating economy; the worst that I have seen in my 26 years in the business. My hope is that business will be better once there is a clearer picture with the financial markets and the election next year.”

Looking Ahead

Although the market in the Southeast has shown some improvement, there is still a divide on how the commercial real estate community feels entering the new year.

“In 2010 and 2011, it was very challenging to do any new development. [We are] hoping and planning for 2012 to be a better real estate development market,” says an undisclosed respondent.

On the contrary, Elizabeth Oates, CFO and partner of Cornelius, North Carolina-based Centurion Partners adds, “At the end of 2010, we thought the deals we were working on would move forward in 2011, [but] sadly that is not the case. We hope [the next year] will be better, however, the ability to borrow money to fund any project is difficult at best. 2012, we believe, is going to be as challenging as 2011.”

©2012 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|