|

SOUTHEAST SNAPSHOT, SEPTEMBER 2008

Nashville Office Market

While Nashville isn’t immune from the economic uncertainties plaguing the country, office development continues in popular submarkets. Cranes can be seen in the Brentwood and Cool Springs/Franklin areas, as well as in the CBD. Soon there will be a crane in the Midtown submarket.

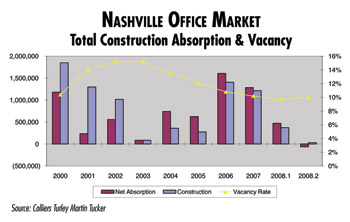

Almost 403,000 square feet of new space has been added to Nashville’s office inventory during the first half of 2008. Absorption still stayed in positive territory at 411,000 square feet. However, all of this came during the first quarter; the office market stalled during the second quarter, with negative net absorption of 62,000 square feet. Many companies are sitting on the fence, delaying hiring decisions as they assess the current state of business.

Against this backdrop, Nashville continues to fare better than most of the nation. Unemployment has inched up at 5.1 percent but still is well below the national average of 5.9 percent. Deal flow may have slowed but some companies are still expanding and renewals continue to occur in most submarkets.

Two chief drivers of Nashville’s office engine are the healthcare industry and the city’s ability to attract new companies to the region.

As for the healthcare industry, it continues to play a key role in the office market. Examples include the largest deal done recently when Vanderbilt Medical leased 440,000 square feet in 100 Oaks Mall, which will bring $64 million in redevelopment and thousands of workers to this center. St. Thomas Health Systems will move into 60,000 square feet in the MetroCenter. Additionally, Healthways (225,000 square feet) and Community Health Systems (179,000 square feet) moved into their new headquarters buildings last year in the Cool Springs/Franklin submarket.

Nashville’s Chamber of Commerce has been highly successful in its economic development efforts. The results speak for themselves—Nissan, Dell, Caremark, Louisiana-Pacific, Asurion and Clarcor are some of the big names attracted to Nashville. Rumors are circulating that another large corporate relocation will be announced soon.

All in all, the Nashville office market is far from overbuilt, with a vacancy rate of 10 percent. Consequently, it is positioned quite well to handle slowing activity.

In the meantime, developers are currently building nearly 2.5 million square feet of new space.

More than half of this new space is going up in the Cool Springs/Franklin submarket, the city’s most dynamic area for office and retail. Located in Williamson County, the 27th wealthiest county in the nation, this submarket flourishes thanks to an availability of land. It doesn’t hurt either that many top executives live in the county.

Buildings underway include: Boyle’s Meridian of Cool Springs with two buildings totaling 153,000 square feet; Crescent Resource’s One Greenway Centre at 164,000 square feet; Duke Realty’s 181,000 square-foot build-to-suit for Verizon; the McEwen Building at 173,000 square feet; and Highwoods’ Cool Springs IV at 155,000 square feet. And Nissan’s new massive headquarters at 450,000 square feet is completed.

Adjacent to Cool Springs, Brentwood also attracts its share of tenants. Maryland Farms recently delivered two new buildings totaling 244,000 square feet. This development, though, leaves little land left for future construction in the Brentwood submarket.

As the suburbs fill, many developers are turning attention to the CBD and Midtown submarkets. Both areas have experienced a residential renaissance, and a proposed $595 million convention center will only boost prospects. Plans call for building to begin next year, with the convention center scheduled for completion in 2012.

Barry Real Estate is building its first project in Nashville in the CBD. The Pinnacle at Symphony Place in SoBro will rise 29 stories and include 529,000 square feet of retail and office space. Crosland’s Terrazo luxury condominium complex in the Gulch area will include 75,000 square feet of office space.

Located at the entrance to the Music Row submarket in Midtown, Lionstone is developing the 1515 Demonbreun building. Scheduled for completion in early 2010, the development will have 250,000 square feet of office space and 25,000 square feet of retail. Earl Swensson Associates, the architectural firm for the building, signed a 60,000 square-foot lease as the development’s anchor tenant.

Additionally, a number of retailers, restaurants and hotels are looking at opportunities in the CBD and Midtown areas.

Short term, though, we expect a dramatic increase in vacancy rates in the CBD as Nissan has just vacated its space at 333 Commerce Street to move to its new headquarters in Cool Springs.

Landlords have been pushing up asking rates throughout the region. Rates range from $26.46 for Class A Space in Green Hills/Music Row to $17.50 for similar space in the MetroCenter. The average existing rental rate throughout Nashville is $21.02 for Class A Space and $16.51 for Class B space. Rates for new CBD and Midtown buildings will be in the low $30s.

Rates should stabilize throughout the rest of the year. Occupancy rates are steady and should improve by year end.

The big question remains: Can Nashville maintain its solid track record in the office market? We are hard-pressed to answer that with any certainty as economic winds seem to change from day to day. We do believe that the market will end the year on a positive note but not nearly as strong in the past several years.

— Jim Smith, SIOR, specializes in office sales and leasing in Colliers Turley Martin Tucker’s regional office in Nashville.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|